Full Exemption from PT Liability Most state governments in India offer complete exemption from professional tax for employees with disabilities. This exemption is granted regardless of the salary or income level of the disabled employee. The benefit is applicable to...

Professional Tax Articles

What is the method to track PT filing history?

Access the State’s Professional Tax Portal Visit the official professional tax or commercial tax portal of the respective state where the registration is held. Log in using valid credentials linked to the Professional Tax Registration Certificate (PTRC) or Enrollment...

What is the impact of PT default on business operations?

Monetary Penalties and Interest Accrual A PT default results in financial penalties, which vary by state and may range from ₹1,000 to ₹5,000 per return or payment default. Interest is charged on outstanding tax dues, generally at 1% to 2% per month from the due date...

What is the penalty for providing false PT information?

Monetary Fine Imposed by Tax Authority Submitting false or misleading information in PT registration, return filings, or declarations attracts a financial penalty. The penalty amount varies state to state but may range from ₹1,000 to ₹5,000 per instance. In some...

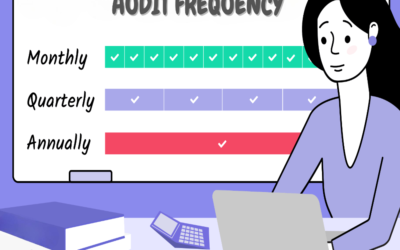

What is the audit frequency for professional tax?

Varies by State Legislation The frequency of professional tax audits is determined by state-specific PT laws and rules. There is no uniform national schedule; each state’s Commercial Tax or Municipal Department decides the audit intervals. Some states conduct audits...

What is the verification process for PT return status?

Login to the State’s PT Portal Visit the official Professional Tax or Commercial Tax Department portal of your respective state. Log in using your valid credentials such as: PTRC number (for employers) or PTEC number (for self-employed individuals). Enter your...

What is the way to obtain PT clearance certificate?

Login to the State Tax Portal Visit the official professional tax portal of the state where your business or professional activity is registered. Use your PTRC (Professional Tax Registration Certificate) or PTEC (Professional Tax Enrollment Certificate) credentials....

What is the effect of leave without pay on PT deduction?

Reduction in Gross Salary When an employee is on leave without pay (LWP), their gross salary for that month is reduced or becomes zero. Since PT is calculated based on monthly gross salary, the deduction amount is affected accordingly. If the salary after adjustment...

What is the eligibility for government employees under PT?

Equal Applicability as Private Sector Employees Government employees, both central and state, are equally liable to pay professional tax under the respective state’s PT Act. There is no exemption solely based on government employment status. PT is applicable to...

What is the best practice for PT compliance for MSMEs?

Timely Registration and Renewal Obtain PTRC (for employers) and PTEC (for business owners or professionals) as soon as the business becomes liable under state rules. Ensure all branches and locations are registered if operations span multiple jurisdictions. Track any...