Government Notification-Based Exemptions Toll exemptions are provided under the National Highways Fee Rules, 2008. Vehicles belonging to specific authorities or categories are eligible. A list of exempted categories is officially notified by the government. Exemptions...

Toll Tax Articles

How is toll tax calculated for multi-axle vehicles?

Vehicle Classification Guidelines Multi-axle vehicles are categorized separately from standard vehicles. They typically include trucks, trailers, and heavy-load carriers. Classification is based on the number of axles and vehicle dimensions. Toll rules assign specific...

What authority regulates toll on state roads?

State Government Departments Toll on state roads is regulated by the respective state governments. Departments such as the Public Works Department oversee toll policies. State road and transport authorities manage toll operations. They draft rules in accordance with...

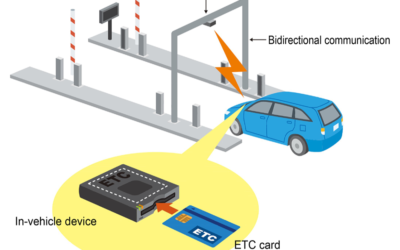

How is toll collected electronically?

Electronic Toll Collection System Electronic toll collection is done using Radio Frequency Identification technology. Vehicles are fitted with prepaid RFID tags for automatic scanning. Toll plazas are equipped with sensors and cameras to detect the tags. The system...

How is toll revenue utilized in India?

Highway Maintenance and Repair A major portion of toll revenue is allocated for maintaining national highways. Regular resurfacing, pothole repairs, and signage updates are funded through tolls. Drainage, lighting, and landscaping are maintained using toll...

What are the penalties for toll evasion?

Double Toll Charge Rule Vehicles without valid toll payment are liable to pay double the fee. This penalty applies to vehicles not carrying valid FASTag or sufficient balance. It is enforced under the National Highways Fee Rules, 2008. The double charge is collected...

What is the legal basis for toll tax in India?

Primary Legislation The toll tax system in India is legally governed by the National Highways Act, 1956. It empowers the central government to levy and collect toll on national highways. The Act provides authority to fix user fees for road usage. It outlines...

How often are toll rates revised?

Annual Revision Schedule Toll rates in India are officially revised once every financial year. The revision typically takes place on April 1 of each year. The updated rates come into effect after government notification. The schedule ensures consistent application...

How are toll rates determined in India?

Legal Framework and Authority Toll rates in India are governed by the National Highways Fee (Determination of Rates and Collection) Rules. These rules are framed under the National Highways Act, 1956. The Ministry of Road Transport and Highways is the primary...

What is the role of NHAI in toll management?

Policy Formulation and Regulation NHAI sets the policies for toll collection on national highways. It defines rules under the National Highways Act and related guidelines. Toll rates and exemptions are framed and notified by NHAI. It ensures compliance with central...