Introduction

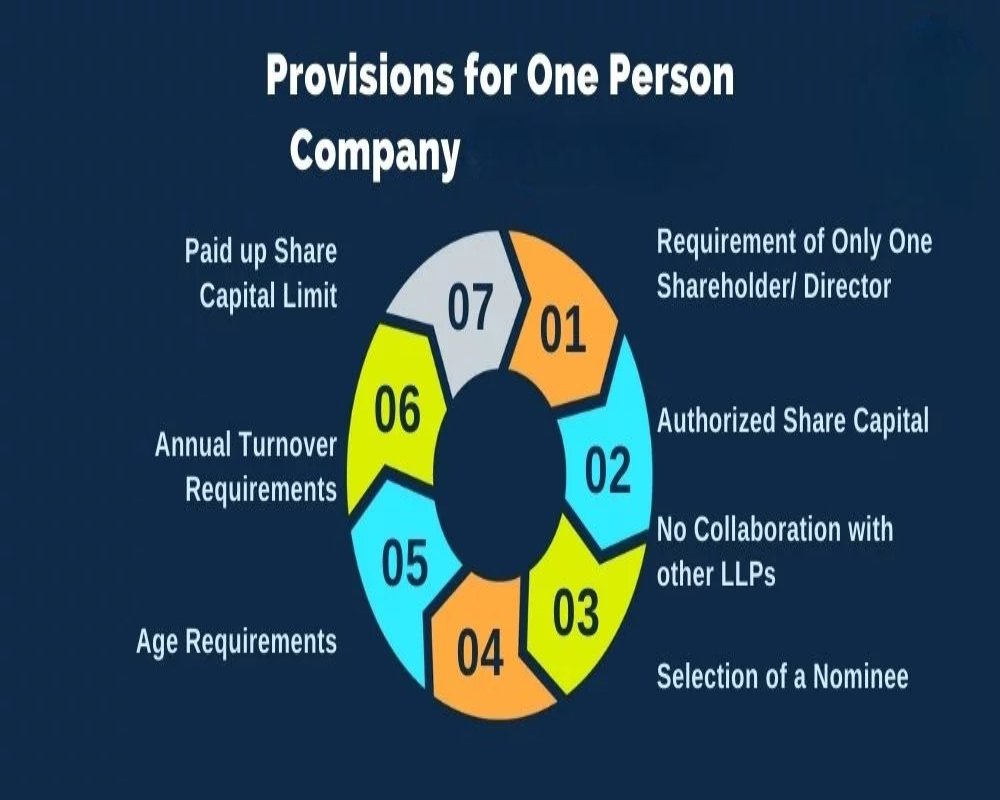

A One Person Company (OPC) is a revolutionary concept in Indian corporate law introduced under the Companies Act, 2013. It provides a legal and operational structure for individual entrepreneurs to operate with the advantages of a corporate entity while enjoying the ease of sole ownership. To maintain its unique position between a sole proprietorship and a private limited company, the OPC is governed by specific provisions that balance flexibility with regulatory oversight. These provisions ensure transparency, accountability, and legal compliance without burdening the individual entrepreneur.

Eligibility Criteria for Incorporation

To incorporate an OPC, the individual must be a natural person, an Indian citizen, and a resident of India (residing in India for at least 120 days during the financial year). Additionally, a person is not allowed to incorporate more than one OPC or become a nominee in more than one OPC at the same time. These provisions are aimed at restricting misuse and ensuring that OPCs are used by genuine individual entrepreneurs.

Nominee Requirement

One of the most distinct provisions for OPCs is the mandatory nominee appointment at the time of incorporation. The nominee must also be a natural person and a resident Indian. The nominee will take over the company in case the sole member becomes incapacitated or dies. The consent of the nominee must be obtained in writing using Form INC-3, and the nominee can withdraw with notice, upon which a new nominee must be appointed.

Naming Guidelines

An OPC must be registered as a private company and its name should include the words “(OPC) Private Limited”. This provision ensures that the nature and ownership structure of the company is clearly reflected in all legal and business dealings.

Minimum and Maximum Share Capital

There is no prescribed minimum paid-up capital required to form an OPC. However, if the paid-up share capital exceeds ₹50 lakhs or if the annual turnover exceeds ₹2 crores, the OPC must mandatorily convert into a private limited company within six months. This provision ensures that larger businesses transition into more regulated corporate forms.

Number of Directors and Board Meetings

An OPC must have at least one director, and can have up to fifteen directors. If the company has only one director, there is no requirement to hold board meetings. However, if there is more than one director, the company must conduct at least one board meeting in each half of the calendar year, with a minimum gap of 90 days between meetings.

Annual Filings and Audit Requirements

OPCs are required to file Annual Return (Form MGT-7A) and Financial Statements (Form AOC-4) with the Registrar of Companies (RoC). The accounts of the OPC must be audited by a Chartered Accountant, even if it is a single-owner entity. This ensures a minimum level of financial transparency and standardization.

Restriction on Business Activities

OPCs are not allowed to engage in Non-Banking Financial Investment (NBFC) activities or acquire securities of other companies. These restrictions are imposed to keep the scope of OPCs limited to small business operations and prevent financial complexities that require larger governance structures.

Taxation and Regulatory Compliance

OPCs are taxed as domestic companies and are subject to applicable corporate tax rates under the Income Tax Act, 1961. They must also comply with GST regulations if turnover exceeds the prescribed threshold. While the compliance requirements are lighter than those for private limited companies, OPCs still must maintain statutory records and meet filing obligations.

Conversion Provisions

Voluntary conversion of an OPC into a private limited company is not allowed before two years from incorporation, unless the turnover or paid-up capital threshold is crossed. After that period, the company can voluntarily convert by following the process under the Companies (Incorporation) Rules, 2014. This provision ensures business maturity before transitioning to a more complex corporate structure.

Conclusion

The One Person Company model is governed by carefully crafted provisions that balance regulatory oversight with operational simplicity. These key provisions make it a highly beneficial structure for solo entrepreneurs, offering them limited liability, business continuity, and legal recognition without overburdening them with compliance. By adhering to these regulations, OPCs can function efficiently while enjoying the protections and advantages of corporate governance. This model plays a critical role in promoting entrepreneurship and integrating informal businesses into the formal economic framework of India.

Hashtags

#OnePersonCompany #OPC #BusinessStructure #Entrepreneurship #SmallBusiness #CompanyFormation #LimitedLiability #SingleMemberCompany #Startups #BusinessCompliance #CompanyRegistration #LegalProvisions #BusinessOwnership #CorporateLaw #IndiaBusiness #StartupIndia #BusinessGrowth #EntrepreneurLife #BusinessTips #CompanyRegulations

0 Comments