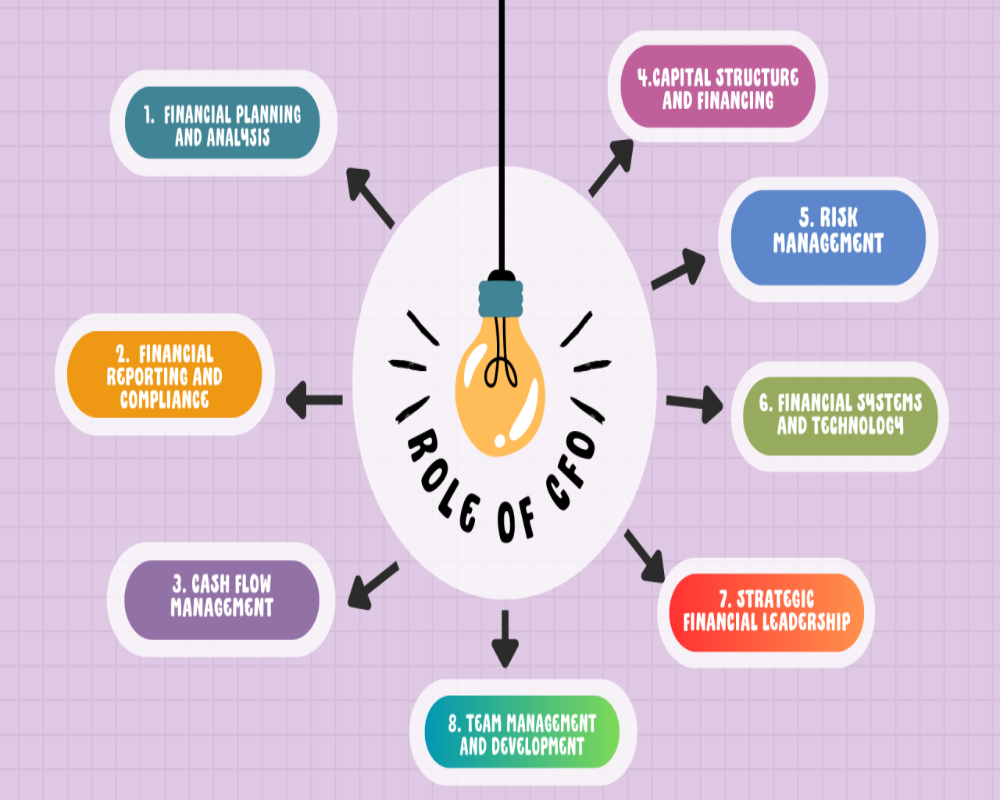

1. Financial Strategy and Planning

- The Chief Financial Officer (CFO) is responsible for the company’s overall financial planning, forecasting, and budgeting.

- They develop and implement strategies to manage capital, improve profitability, and support sustainable growth.

- The CFO works closely with the Board and CEO to align financial objectives with business goals.

- They evaluate investment opportunities, mergers, and expansion plans to ensure financial viability and long-term value creation.

- The CFO plays a key role in capital structuring and cost management.

2. Financial Reporting and Compliance

- A CFO ensures that all financial statements are accurate, timely, and compliant with the Companies Act, SEBI regulations, and applicable accounting standards (Ind AS).

- They oversee the preparation and filing of statutory returns, including quarterly and annual reports.

- The CFO certifies financial results under Regulation 33 of the SEBI (LODR) Regulations for listed companies.

- They are responsible for ensuring compliance with tax laws, GST, RBI, and FEMA regulations.

- Any financial disclosures to investors, stock exchanges, or regulators fall under their purview.

3. Internal Controls and Risk Management

- The CFO is in charge of designing and maintaining robust internal financial controls.

- They identify financial risks (credit, liquidity, market) and implement risk mitigation strategies.

- The CFO supports the Audit Committee and Risk Management Committee in their oversight roles.

- They ensure regular audits (internal, statutory, and tax) and follow up on audit observations and compliance gaps.

- They also establish anti-fraud frameworks and promote financial discipline.

4. Stakeholder Communication and Investor Relations

- The CFO serves as a key liaison between the company and external stakeholders such as analysts, investors, bankers, credit rating agencies, and regulators.

- They manage earnings calls, investor presentations, and financial press releases.

- Clear communication of the company’s financial health and performance helps maintain market confidence and share value.

- The CFO supports equity and debt capital raising through IPOs, rights issues, or private placements.

5. Operational Oversight and Decision Support

- Beyond finance, the CFO influences supply chain, procurement, HR, and IT budgeting decisions.

- They monitor operational metrics and ensure resources are allocated efficiently.

- They support cost-benefit analyses, contract negotiations, and strategic partnerships.

- The CFO helps align operational decisions with financial impact, driving efficiency and accountability across departments.

- Their role is increasingly strategic, analytical, and technology-driven in modern Public Limited Companies.

0 Comments