Varies by State Legislation

- The frequency of professional tax audits is determined by state-specific PT laws and rules.

- There is no uniform national schedule; each state’s Commercial Tax or Municipal Department decides the audit intervals.

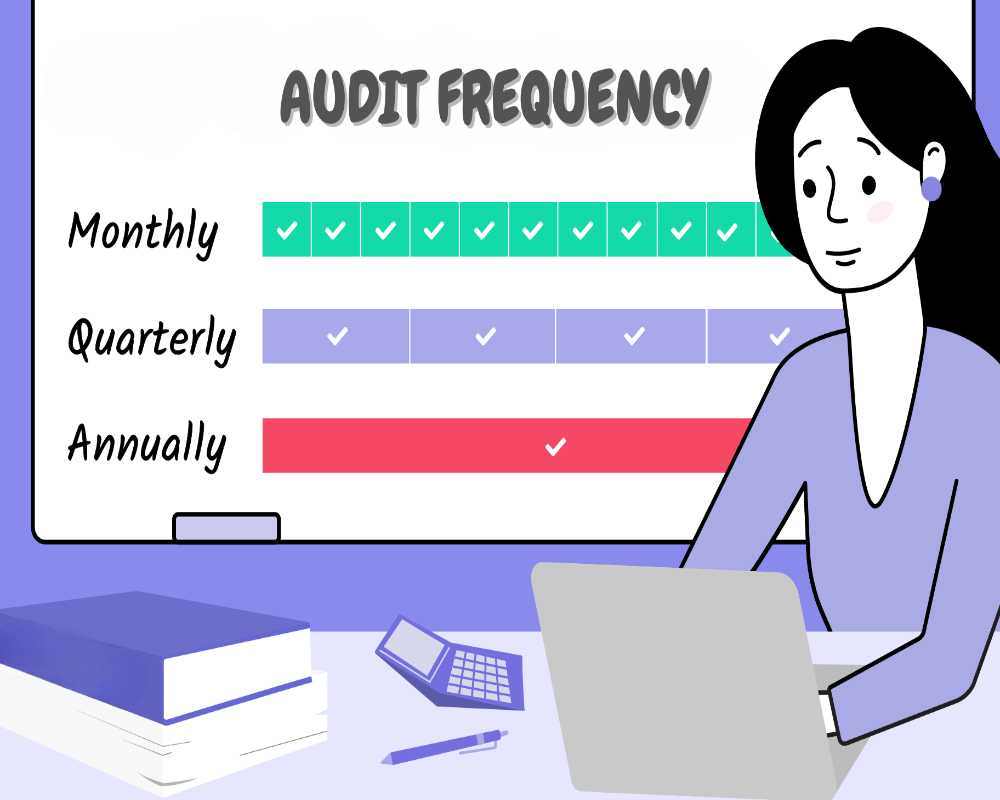

- Some states conduct audits annually, while others may follow a biennial or risk-based audit model.

- Businesses should refer to their local PT authority’s circulars or compliance notifications for clarity.

- The audit frequency may also depend on the nature and scale of business operations.

Risk-Based and Turnover-Based Selection

- PT departments may audit businesses based on turnover, employee size, tax paid, or compliance history.

- MSMEs or low-risk taxpayers may face audits once in several years, especially if returns and payments are consistent.

- High-volume employers, defaulters, or late filers may be audited more frequently or randomly selected.

- Some states maintain a compliance rating system to identify targets for audit.

- Sudden spikes or drops in PT payments may also trigger audit flags.

Event-Triggered Audits

- Audits can be triggered outside the regular cycle due to specific events, such as:

- Late payment or non-filing of returns.

- Employee grievances or complaints about improper deduction.

- Mismatch in return data and payment challans.

- Change in registration details such as branch expansion or ownership transition.

- Late payment or non-filing of returns.

- These are often surprise or special audits focusing on a specific period or transaction.

Notice and Preparation Period

- Departments typically issue an official audit notice specifying:

- Period to be audited (e.g., last 3–5 years).

- List of required documents (e.g., payroll, returns, challans).

- Audit schedule and officer details.

- Period to be audited (e.g., last 3–5 years).

- Businesses are usually given a preparation window of 7 to 15 days to organize and submit records.

- The audit may be conducted onsite or online, depending on the state’s procedure.

Post-Audit Review and Penalty Assessment

- After the audit, a review report is issued highlighting discrepancies, if any.

- Businesses are required to rectify errors or pay additional tax, interest, or penalties if demanded.

- Clean audits contribute to better compliance ratings and fewer future inspections.

- Failing to cooperate with the audit process may lead to legal action or re-audit.

0 Comments