Overview of VAT Rate Structure in India

• The VAT rate structure in India was designed by each state but followed a harmonized framework

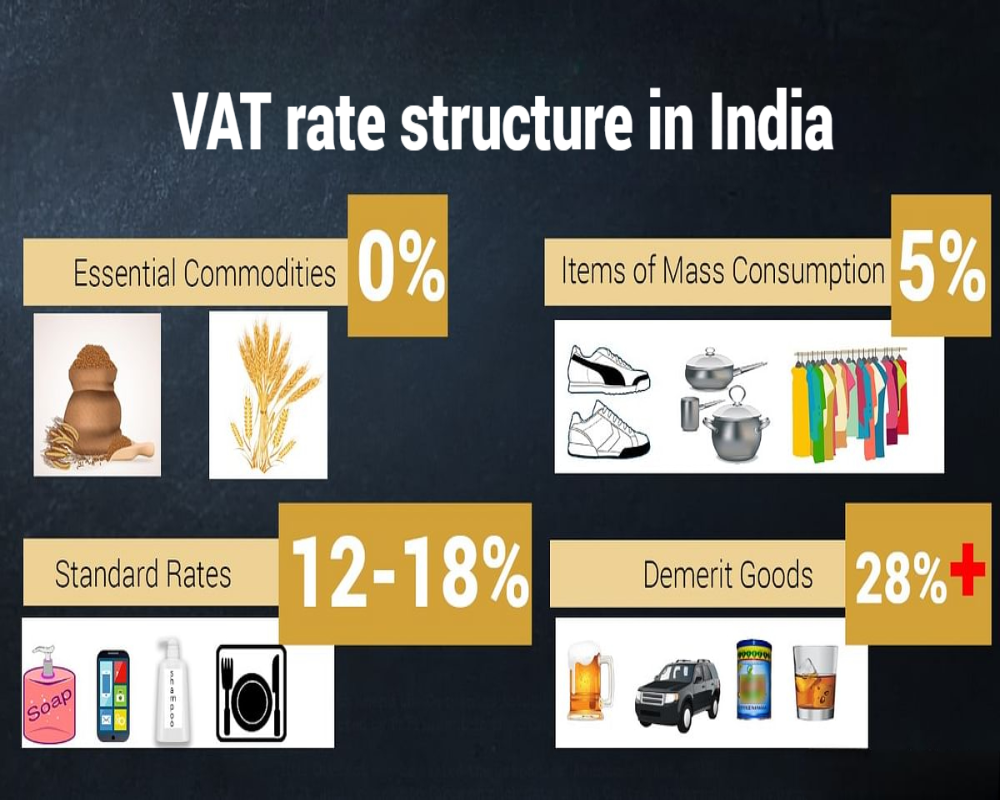

• It included multiple tax slabs based on the nature and essentiality of goods being sold

• Most states adopted a common classification model with slight variations in specific rates

• Goods were categorized into exempted low-rate standard-rate and special-rate items

• The rate structure aimed to balance revenue generation with consumer affordability

Zero and Exempted Rate Category

• Basic necessities like milk vegetables salt and unbranded cereals were kept tax-free

• Life-saving drugs agricultural tools and textbooks were also exempted from VAT

• Zero-rated goods were meant to reduce the tax burden on economically sensitive products

• Exemption lists varied slightly from state to state based on local policy priorities

• Dealers selling only exempt goods were not required to register under VAT laws

Lower VAT Rate Category

• A lower rate of 1 to 5 percent was applied on essential goods and items of mass consumption

• This included edible oil medicines sugar tea coffee and unbranded packaged food items

• Handlooms utensils bicycles and certain household items also fell under this category

• The objective was to support common consumers and reduce inflationary pressures

• These goods attracted input tax credit provisions like other taxable items

Standard VAT Rate Category

• The standard VAT rate across most states was 12.5 percent applied to general goods

• This included furniture electronics computers branded foods and household appliances

• It was the most commonly used slab in business-to-business and retail trade

• Dealers were eligible to claim full input tax credit on goods taxed at the standard rate

• This rate ensured a significant contribution to state revenue while maintaining neutrality

Higher and Special VAT Rate Category

• Luxury goods and sin products like alcohol tobacco and petroleum products attracted higher VAT rates

• Gold bullion and precious metals were often taxed at concessional rates around 1 percent

• Some states applied special rates on motor vehicles air-conditioners and branded garments

• These rates were designed either for revenue maximization or policy disincentives

• VAT rates on petroleum and liquor continued even after GST due to their exclusion from the new regime

0 Comments