Understanding Input VAT Exceeding Output VAT

- This situation arises when a business pays more VAT on purchases (input) than it collects on sales (output)

- It typically occurs in cases of low sales, high stock accumulation, or capital investment

- Input VAT may also exceed output VAT if the business deals in zero-rated or exempt supplies

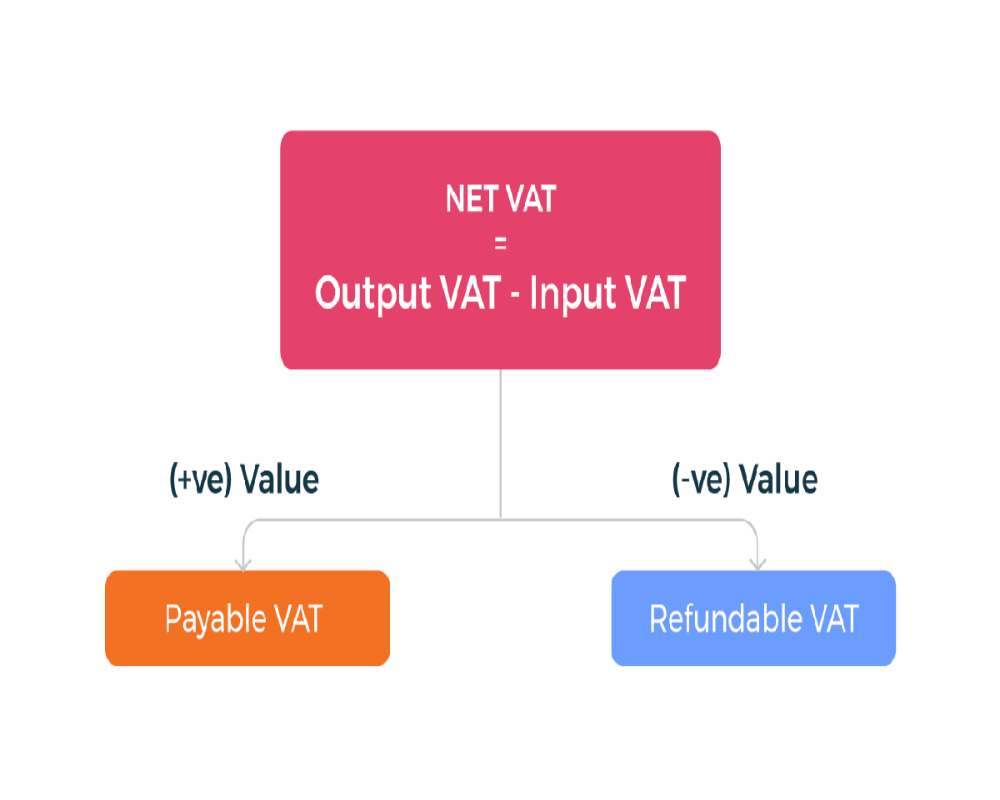

- This difference results in a net VAT credit position for the business

- The excess input VAT can either be carried forward or claimed as a refund, depending on the law

Options Available for the Excess Input VAT

- The excess input VAT is usually carried forward to the next tax period

- It can be used to offset future output VAT liability in upcoming returns

- In specific cases, such as exports or exempt sales, businesses may claim a refund

- Some states allow partial refunds subject to documentation and verification

- Refund or carry-forward must be duly declared in VAT returns with supporting records

Conditions for Claiming Refund

- Refund can be claimed only if the VAT return is filed correctly and timely

- Businesses must submit supporting documents such as purchase invoices, VAT challans, and stock records

- Exporters must provide Form H and shipping documentation to justify zero-rated sales

- Refund applications often require a CA certification or departmental audit

- The refund process is subject to approval by the VAT officer, and delays may occur

Impact on Accounting and Cash Flow

- Excess input VAT is shown as a recoverable asset in the books until adjusted or refunded

- It may improve cash flow in future periods by reducing tax payments

- In the short term, it may tie up working capital if refunds are delayed

- Accurate VAT reconciliation ensures the excess credit is not lost or disputed

- Proper classification of purchases helps in determining eligible and ineligible input VAT

Post-GST Implications and Legacy Treatment

- Under GST, similar provisions exist for input tax credit and refunds, improving uniformity

- Excess input VAT under the old VAT regime remains relevant for legacy returns and audits

- Businesses may still have pending refund claims or assessments under pre-GST laws

- It is important to retain documentary evidence for any carried-forward input VAT

Understanding VAT credit management helps in closing old tax periods correctly

0 Comments