Introduction

Once a business completes the GST registration process and receives approval from the tax department, a GST registration certificate is issued. This certificate serves as legal proof that the business is registered under the Goods and Services Tax law and is authorized to collect tax, issue GST invoices, and claim input tax credit. The certificate contains vital details such as the business name, address, GSTIN, date of registration, and type of taxpayer. Although no physical certificate is sent by post, the certificate can be downloaded at any time from the official GST portal. This certificate is an important document and is required for bank accounts, tenders, audits, client onboarding, and inspections. Knowing how to access and download the certificate accurately ensures that businesses remain prepared for verification, contract compliance, and regulatory requirements.

Logging into the GST portal

To download the GST registration certificate, the taxpayer must first visit the official GST portal. The website provides access to all GST-related services, including registration, return filing, payment, and certificate download. The taxpayer must log in using the unique GSTIN and password issued during registration.

Navigating to the user dashboard

Once logged in, the user is directed to the dashboard. This dashboard displays key information such as pending returns, notices, filing status, and profile summary. The navigation menu on the left side of the screen provides access to various services. For certificate download, the relevant path is located under the ‘Services’ section.

Accessing the registration tab

In the ‘Services’ section, the user must select the ‘User Services’ option. Under this, there is a submenu titled ‘View/Download Certificates’. Clicking on this option opens a list of certificates issued to the taxpayer, including the GST registration certificate. The user can select the appropriate certificate to view further details.

Viewing certificate details

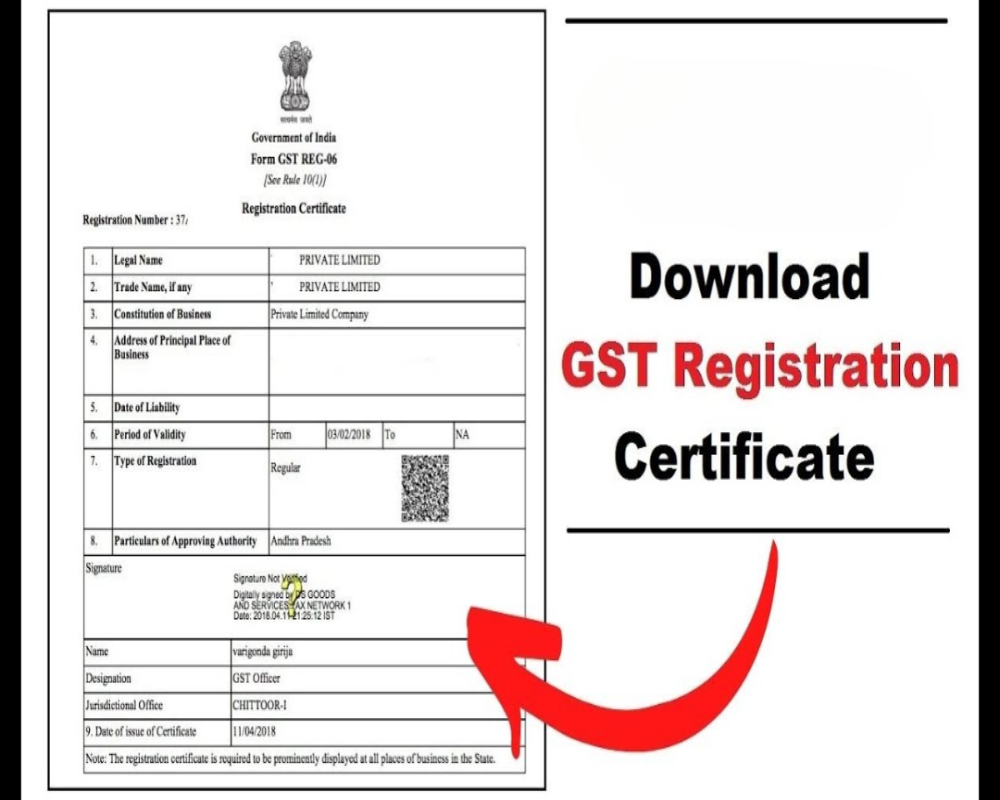

The GST registration certificate displays comprehensive information. This includes the legal name of the business, trade name, GSTIN, registration type, jurisdiction, and date of registration. The certificate also includes a QR code for digital verification and a table listing any additional places of business or amendments.

Downloading the certificate in PDF format

The certificate can be downloaded by clicking the ‘Download’ or ‘Print’ button located on the page. It is generated as a PDF file that can be saved, printed, or emailed as needed. Businesses are advised to store a copy in both digital and printed formats for quick reference and regulatory purposes.

Verifying the certificate content

After downloading, it is essential to verify the accuracy of the details in the certificate. This includes checking the spelling of the business name, PAN, GSTIN structure, and address. If any errors are found, the taxpayer must initiate a correction by filing an amendment through the GST portal.

Use of the certificate in business activities

The GST registration certificate is a foundational document for business operations. It must be displayed prominently at all places of business. The GSTIN mentioned on the certificate must be printed on invoices, delivery notes, e-way bills, and contractual documents. The certificate may also be requested by vendors, clients, banks, and government departments.

Re-downloading or retrieving the certificate

In case the original certificate is misplaced or deleted, it can be re-downloaded from the portal at any time. There is no restriction on the number of downloads. The GST portal maintains a record of the issued certificate and any amendments made, making it easy for users to retrieve updated versions as needed.

Conclusion

The GST registration certificate is a vital document that confirms the legal identity of a registered taxpayer under GST law. Being able to access and download the certificate quickly from the GST portal is essential for smooth business functioning, client transactions, and regulatory compliance. By understanding the step-by-step procedure, businesses ensure they are always equipped with valid documentation. Regular verification and secure storage of the certificate support credibility, trust, and readiness for audits or verification by any authority.

Hashtags

#GSTRegistration #DownloadGSTCertificate #GST #TaxCompliance #BusinessRegistration #GSTFiling #IndiaGST #DigitalIndia #TaxpayerServices #EcommerceIndia #SmallBusiness #StartupIndia #GSTHelp #TaxDocuments #OnlineServices #BusinessGrowth #FinancialLiteracy #Entrepreneurship #GovernmentServices #TaxEducation

0 Comments