Accessing the Employer Portal

- Log in to the ESIC employer portal using your 17-digit code and password.

- Ensure that your establishment profile and employee details are updated.

- Navigate to the section for contribution submission or challan generation.

- Select the appropriate contribution period before proceeding.

- Use a stable internet connection to avoid data interruption.

Entering Contribution Details

- Provide the wage details for each insured employee for the selected month.

- The portal auto-calculates the employer and employee contributions.

- Verify the employee-wise summary before moving forward.

- Ensure that there are no missing or incorrectly reported employees.

- Correct any errors before finalizing the contribution entry.

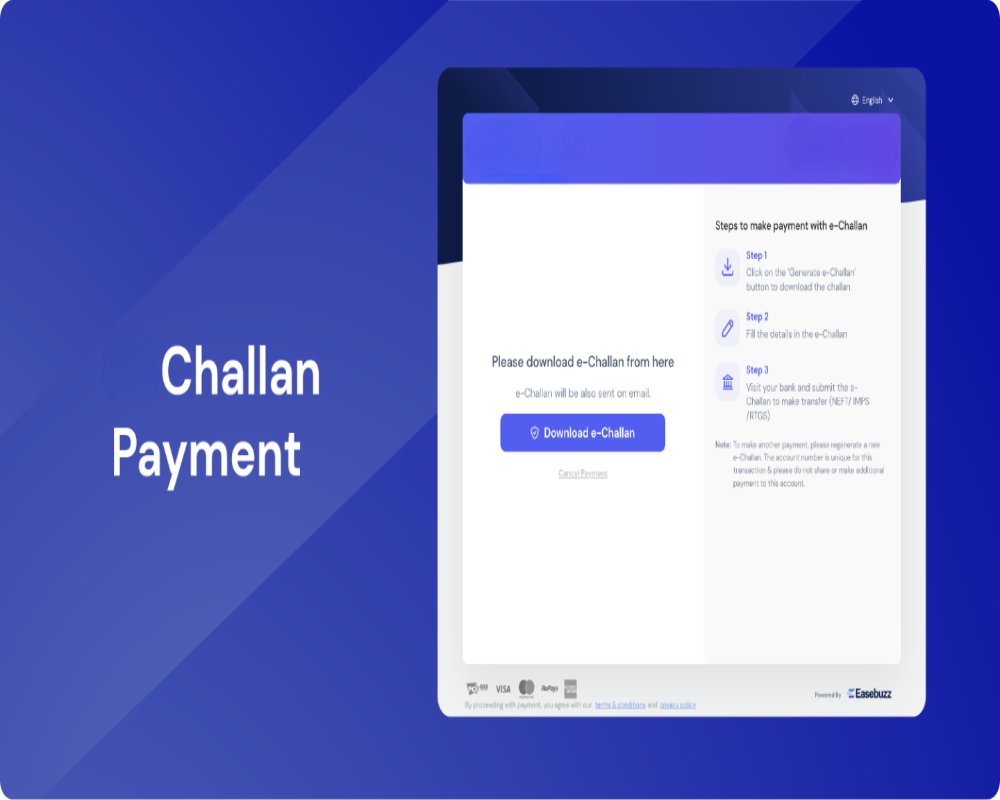

Generating the Challan

- Once all data is reviewed, select the option to generate the challan.

- The system displays the total payable amount and transaction summary.

- Confirm the details and click on the generate challan button.

- A unique challan reference number is created upon generation.

- Download and save the challan copy for your records.

Selecting the Payment Mode

- After challan generation, proceed to the payment section.

- Choose from available online payment methods such as net banking.

- If offline payment is permitted, print the challan for bank submission.

- Ensure that payment is completed before the due date.

- Always retain a copy of the payment receipt for future reference.

Post-Challan Actions

- After successful payment, the challan status will update automatically.

- You must submit the monthly return linked to the paid challan.

- The portal will generate an acknowledgment after return filing.

- Verify that the challan appears in your payment history.

- Maintain all challan and return documents for ESIC audit compliance.

0 Comments