by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

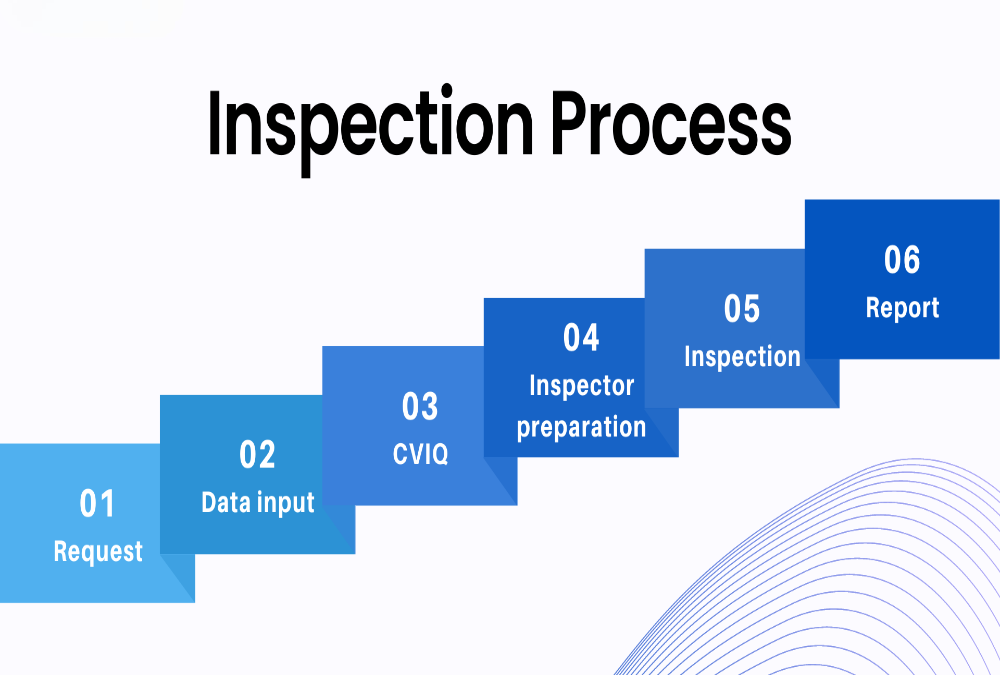

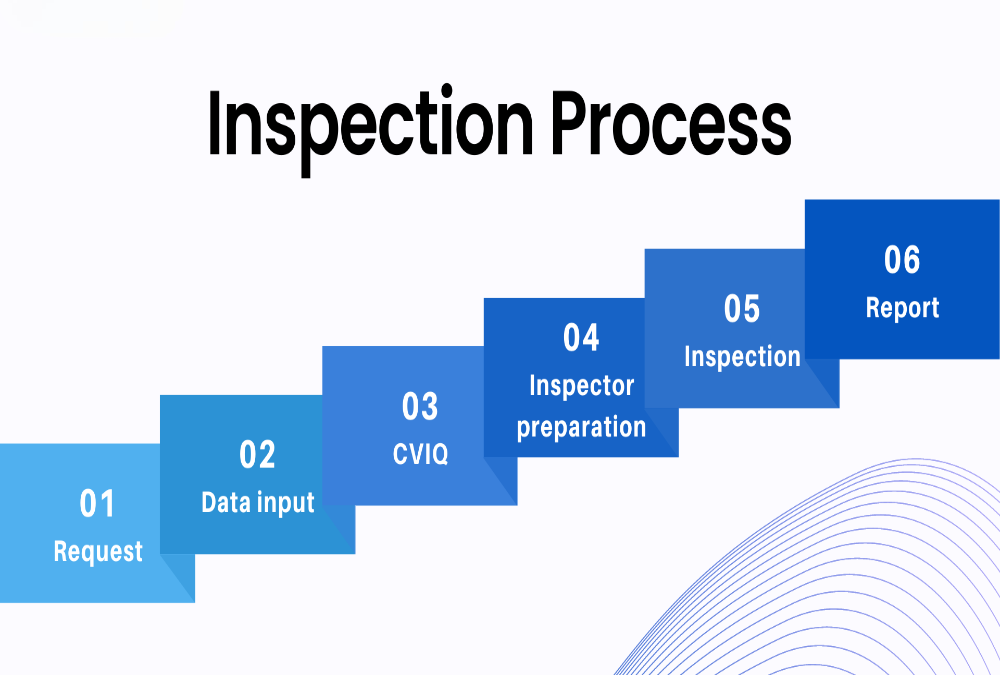

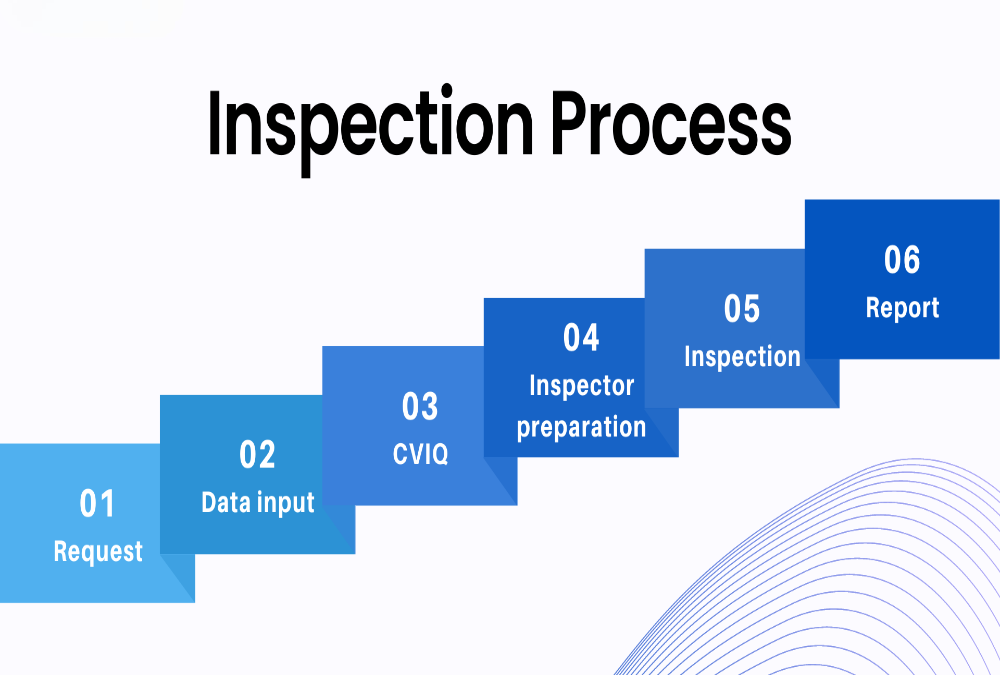

Purpose of ESIC Inspection The inspection ensures employer compliance with the Employees’ State Insurance Act. It verifies the accuracy of contributions, employee records, and wage declarations. Inspections help detect under-reporting, omissions, or delayed filings....

by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

Login to the Employer Portal Visit the official ESIC employer portal and log in using your credentials. Enter the 17-digit employer code and password assigned during registration. Ensure secure access by using an updated browser. Navigate to the main dashboard upon...

by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

Basic Employer Information Name of the establishment as per ESIC registration records. 17-digit employer code assigned during registration. Complete address of the business or branch office. Email ID and contact number of the authorized signatory. Contribution period...

by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

Legal Framework for Penalty Penalties for late ESI return filing are governed by the Employees’ State Insurance Act, 1948. Section 85 and associated regulations prescribe consequences for non-compliance. The Act authorizes ESIC to levy fines, interest, and damages....

by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

Common Errors in ESI Returns Incorrect entry of employee wages or ESIC number. Omission of eligible employees in the return. Inclusion of ineligible or exited employees. Filing return for the wrong contribution period. Miscalculation of employer or employee...