by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

Common Types of Payment Errors Incorrect employee wage entry resulting in overpayment or underpayment. Payment made for the wrong contribution period. Duplicate payment due to system or operator error. Missing employee records in the contribution sheet. Wrong ESIC...

by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

Situations Requiring Revision Errors in employee wage data during the original filing. Incorrect calculation of employer or employee contribution. Addition of employees omitted during the initial submission. Revision due to updated salary components or attendance....

by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

Definition of Contribution Period The ESIC contribution period refers to the fixed duration during which contributions are payable. It defines when employees and employers must make ESIC payments. There are two contribution periods in a year. These periods are uniform...

by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

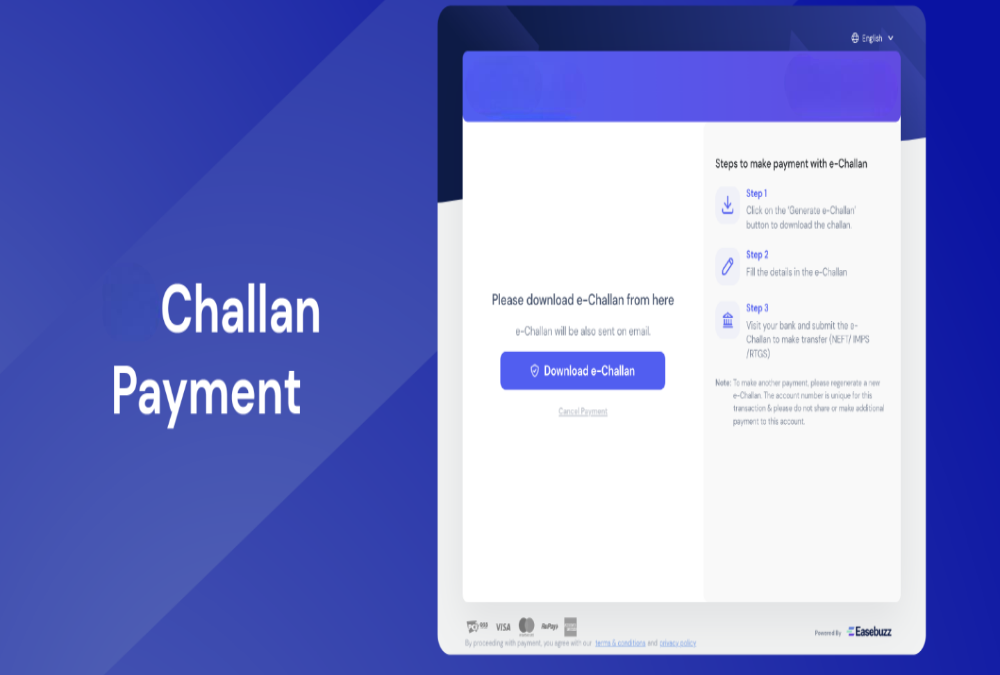

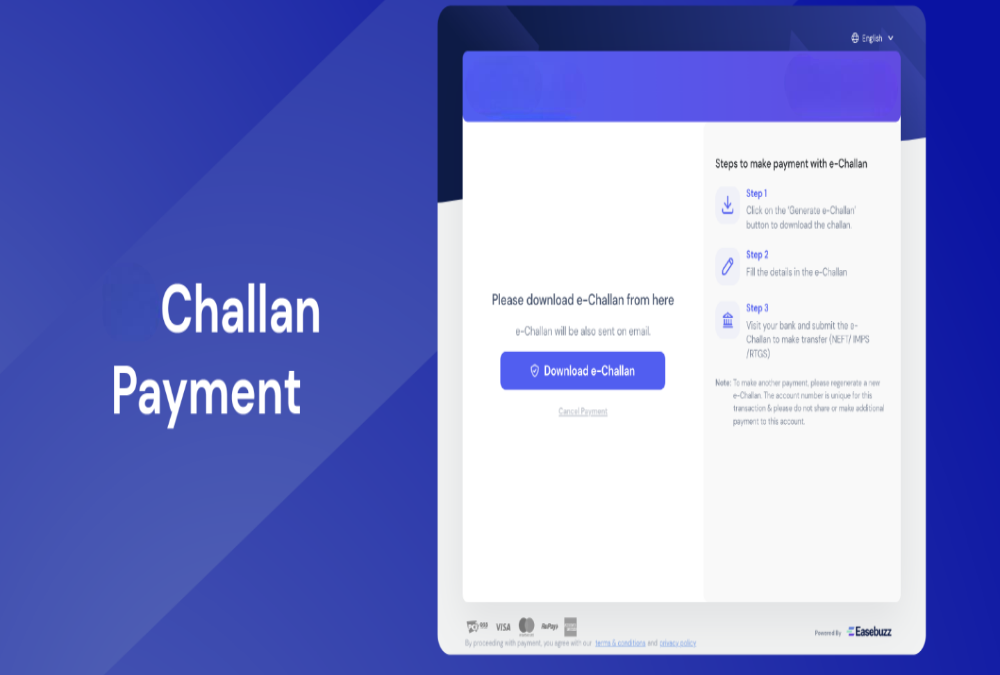

Accessing the Employer Portal Log in to the ESIC employer portal using your 17-digit code and password. Ensure that your establishment profile and employee details are updated. Navigate to the section for contribution submission or challan generation. Select the...

by Audit Analyst | Jan 2, 2026 | Employees State Insurance Corporation

Primary Mode of Payment ESIC contributions are primarily paid through online payment methods. Employers use the official portal to generate and pay challans. The online system is the default mode for all monthly filings. Payment and filing are integrated within the...