by Audit Analyst | Dec 17, 2025 | PAN

What Is the Role of PAN in Scrutiny Assessment in India? PAN (Permanent Account Number) plays a central role in scrutiny assessment under the Income Tax Act. It serves as the unique identifier for tracking the taxpayer’s financial history, verifying return...

by Audit Analyst | Dec 17, 2025 | PAN

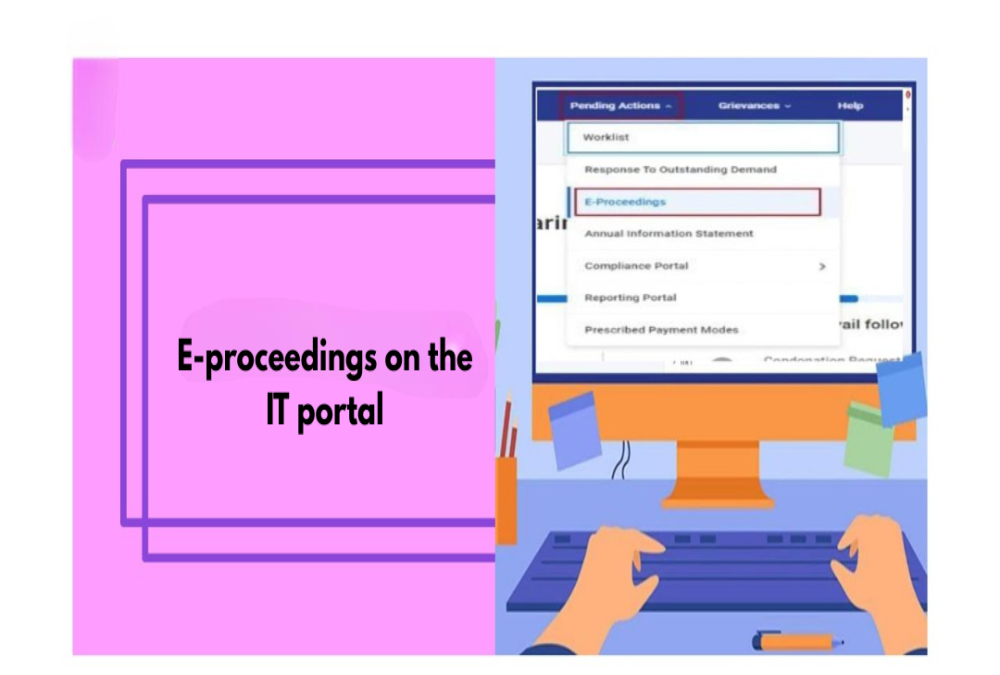

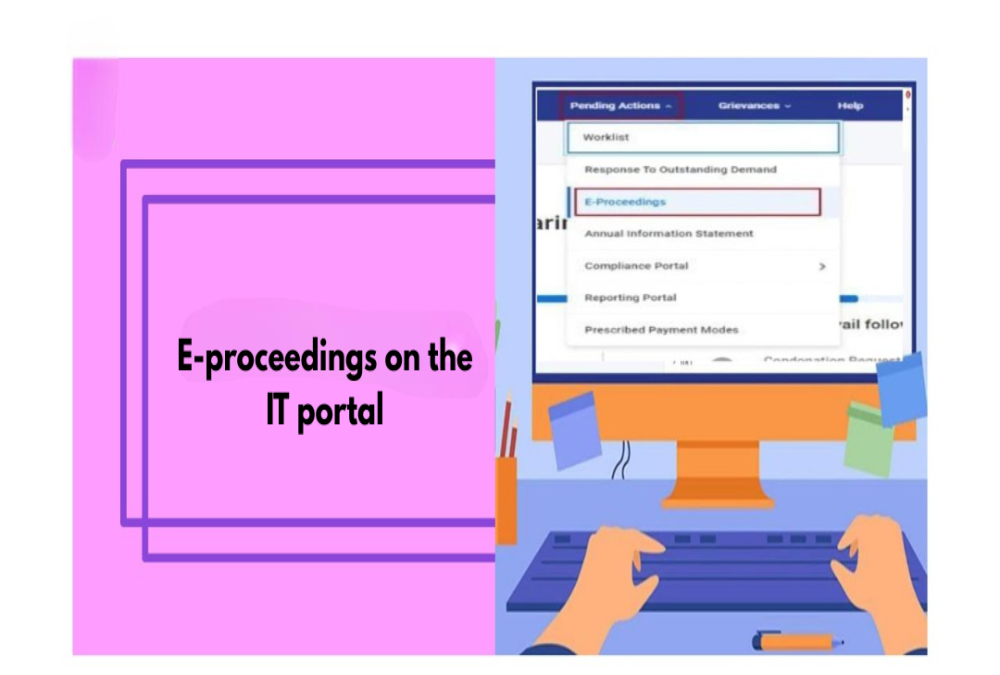

How to Use PAN for e-Proceedings on the IT Portal in India PAN (Permanent Account Number) is the central identifier used for accessing and responding to e-Proceedings — a paperless communication mechanism between taxpayers and the Income Tax Department. All notices,...

by Audit Analyst | Dec 17, 2025 | PAN

How Is PAN Used in Tax Audit Reporting in India? In India, PAN (Permanent Account Number) is an essential identifier in tax audit reporting under the Income Tax Act. It is used by auditors and taxpayers to ensure transparency, accuracy, and traceability of income,...

by Audit Analyst | Dec 17, 2025 | PAN

What Is the Role of PAN in Advance Tax Payment in India? The Permanent Account Number (PAN) plays a central role in the advance tax payment system. It ensures that the tax paid in advance is correctly recorded and credited to the correct taxpayer’s account. PAN serves...

by Audit Analyst | Dec 17, 2025 | PAN

How to Rectify PAN Errors in Income Tax Portal Errors in your PAN (Permanent Account Number) can cause issues while filing ITR, verifying returns, or claiming refunds. The Income Tax e-Filing portal allows users to correct such PAN-related errors through specific...