by Audit Analyst | Dec 17, 2025 | PAN

Can PAN Be Suspended by the Tax Department in India? Yes, the Income Tax Department has the authority to suspend or deactivate a PAN (Permanent Account Number) under specific legal circumstances. Suspension is generally done to enforce compliance, prevent fraud, or...

by Audit Analyst | Dec 17, 2025 | PAN

How to Raise Grievances Related to PAN in India If you face issues related to PAN (Permanent Account Number) such as delays, incorrect details, or service complaints, you can raise a grievance through various official channels. The Income Tax Department and PAN...

by Audit Analyst | Dec 17, 2025 | PAN

How to Know PAN Jurisdiction in India PAN (Permanent Account Number) jurisdiction refers to the specific Income Tax office or assessing officer assigned to handle your tax matters. This includes assessment, verification, scrutiny, and correspondence. Knowing your PAN...

by Audit Analyst | Dec 17, 2025 | PAN

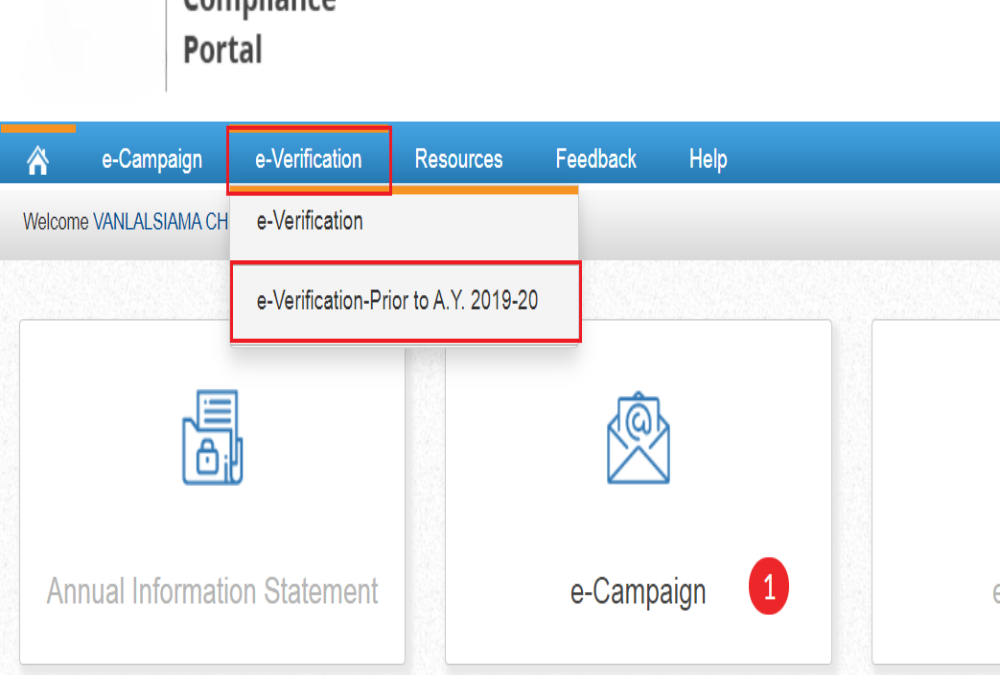

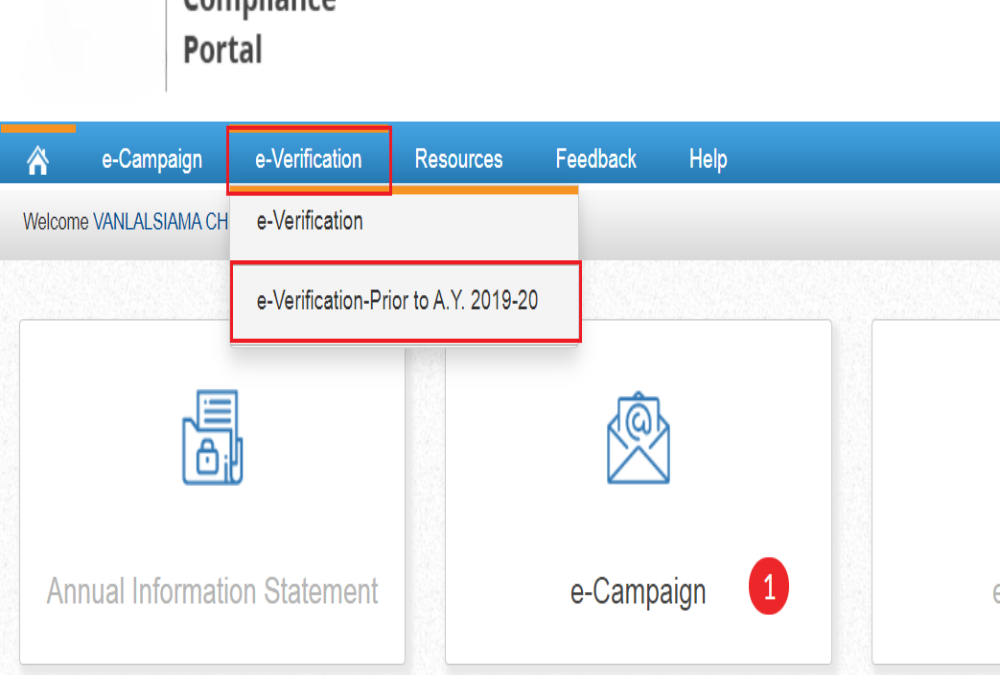

What Is the PAN-Based Compliance Portal in India? The PAN-based compliance portal is a digital interface provided by the Income Tax Department to help taxpayers respond to notices, verify financial transactions, and comply with tax regulations. It uses the PAN...

by Audit Analyst | Dec 17, 2025 | PAN

How to Check Tax Liability Using PAN in India Your PAN (Permanent Account Number) serves as the key to accessing all your income tax-related information online. You can check your tax liability, including outstanding dues, demand notices, and advance tax status,...